British Columbia will now become the first jurisdiction in Canada to statutorily permit and regulate benefit corporations (“B Corps”).

Bill M 209, the Business Corporations Amendment Act (No. 2), 2019, which was originally introduced as a private members bill by Dr. Andrew Weaver, received Royal Assent on May 16, 2020, and is set to come into force on June 30, 2020.

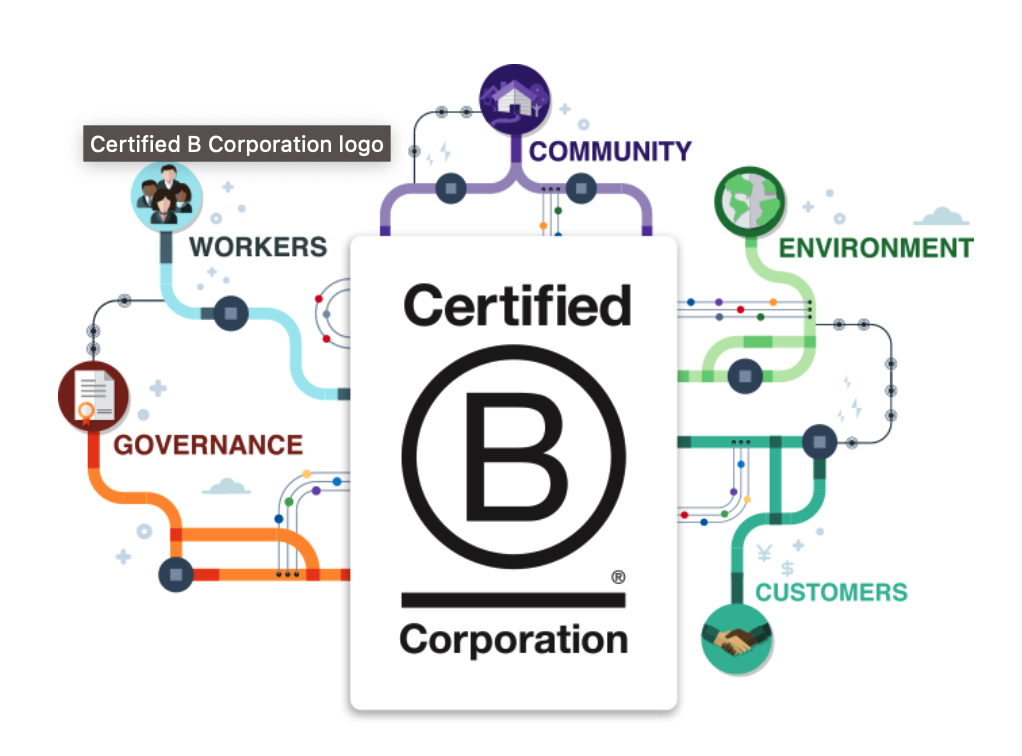

In a previous blog post [hyperlink first BCorp blog], we discussed the concept of “B Corps”. B corp is a certification granted by the non-profit B Lab that signifies a for-profit company voluntarily meets the highest standards of social and environmental performance, public transparency and legal accountability. It is a symbol that the company balances both profit and societal purpose, instead of the standard corporate purpose of maximizing profit.

Now, “Benefit Company” legislative status is coming to British Columbia.

Benefit Companies in B.C.

Standard models of corporate governance require corporate directors to exercise their fiduciary duties by acting in the best interests of the company. This has sometimes been interpreted as putting a priority on maximizing shareholder profit (though that concept has received more traction in the United States as opposed to Canada). Benefit corporations, in contrast, must conduct their affairs to create a general public benefit. Thus, at its core, a benefit company is a for-profit company that commits to conducting its business in a responsible and sustainable way.

Bill M 209 will amend the BC Business Corporations Act (“BCBCA”) by introducing the concept of “benefit companies” as an opt-in model. Incorporated B.C. companies can become benefit companies by changing their notice of articles and articles (on a special resolution of its shareholders).

A benefit company’s articles must contain a provision setting out the company’s commitment to conducting business in a responsible and sustainable manner and to promote specific public benefits, and their notice of articles must contain the following statement:

This company is a benefit company and, as such, is committed to conducting its business in a responsible and sustainable manner and promoting one or more public benefits.

Benefit companies can choose what type of public benefit they want to promote. “Public benefit” is defined in the legislation as follows:

“public benefit” means a positive effect, including of an artistic, charitable, cultural, economic, educational, environmental, literary, medical, religious, scientific or technological nature, for the benefit of

(a) a class of persons, other than shareholders of the company in their capacity as shareholders, or a class of communities or organizations, or

(b) the environment, including air, land, water, flora and fauna, and animal, fish and plant habitats;

Bill M 209 also creates the right for a corporate shareholder, regardless of whether the shareholder’s shares carry the right to vote, to dissent to a resolution (either to add or delete a benefit statement or benefit provision). In such a case, the existing procedure set out in the BCBCA regarding dissent proceedings must be followed.

Newly incorporating companies that wish to be benefit companies will go through the standard incorporation process under the BCBCA and must include the above items in their articles and notice of articles. Benefit companies are not required to include the words “Benefit Company”, “B.Co.” or the like as part of its legal name.

A company can cease being a benefit company by removing the benefit statement from its notice of articles (on a special resolution of its shareholders).

Benefit Reports and Governance

A benefit company must annually publish (and make publicly accessible) a benefit report outlining how it conducted its business in a responsible and sustainable manner and how it promoted its public benefits. A benefit company must choose a third-party standard that it will use to assess its performance in meeting its commitments, but the assessment itself is conducted by the benefit company – the third party does not perform the actual assessment, and there is no government oversight over the assessment.

The benefit report does not have to be filed with the corporate registry, but it must be kept at the company’s registered office, where it must be accessible to the public without charge. If the benefit company has a publicly accessible website, it must post the benefit report there as well.

Under the legislative framework governing benefit companies, directors and officers are required to act honestly and in good faith with a view to conducting business in a responsible and sustainable manner and promoting the company’s public benefits. This duty must be balance with their duty under s.142(1)(a) of the BCBCA to act honestly and in good faith with a view to the best interests of the company.

As a measure of protection for directors and officers, the only persons who have the ability to bring a legal proceeding in relation to the public benefit duty are the shareholders who hold, in aggregate, at least 2% of the issued shares of the company (or, in the case of a public company, the lesser of 2% of the issued shares of the company or issued shares of the company with a fair market value of at least $2,000,000), and the courts cannot order monetary damages against a director or officer for breaching the public benefit duty.

What are the Benefit of Becoming a Benefit Company?

In BCE Inc. v. 1976 Debentureholders (2008 SCC 69) (“BCE”), the Supreme Court of Canada permitted, and perhaps even required, corporate directors to take the interests of affected stakeholders – such as shareholders, employees, creditors, consumers, governments and the environment – into account in considering what is in the best interests of the company. In that sense, Canadian corporate directors have never had the “maximize shareholder profit at all costs” mandate that we see in the United States which spawned the B Corp movement. Nevertheless, under the benefit company structure, public benefits and the interests of certain (non-shareholder) stakeholders can now be clearly and expressly prioritized.

Similar to the benefit of B Corp certification, becoming a benefit corporation may be a means for a company to attract and engage employees, earn positive press, gain community trust and loyalty, build industry connections, and achieve a competitive advantage in the marketplace. It is also a means to allow companies to brand themselves as responsible contributing members of their community and set them apart from industry norms, and be an attractive investment for socially-conscious investors.

Benefit corporation status may be of particular interest for companies operating in the Outdoor/Adventure industry, whose customers and employees may be likely to share such values.

Note: This article is of a general nature only and is not exhaustive of all possible legal rights or remedies. In addition, laws may change over time and should be interpreted only in the context of particular circumstances such that these materials are not intended to be relied upon or taken as legal advice or opinion. Readers should consult a legal professional for specific advice in any particular situation.